Accountants: What is A Sale-Leaseback & How Can It Help Your Client?

Did you know that professional office owner-occupiers can increase their liquidity, improve their balance sheet, gain tax benefits, and stay in their current office space through a sale-leaseback?

Business owners and professionals are experiencing one of the biggest challenges they have faced in their lifetime. High interest rates are keeping property owners trapped in properties they may want or need to sell, and making accessing the capital through refinancing or equity lines too expensive.

If your client owns and occupies their professional or medical office, a sale-leaseback may be the solution.

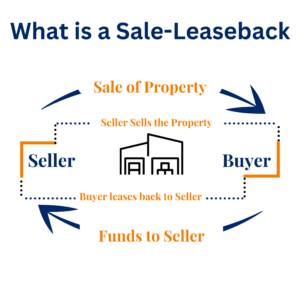

A sale-leaseback is when a property owner who also occupies the building or space, sells the real estate but continues to operate their business in the property by leasing the space back from the new owner.

The arrangement is useful when a property owner needs or wants to:

- Gain access to the equity locked in the value of the real estate but they don’t want to, or it is not financially convenient to refinance or take out an equity line of credit. Today’s high interest rate landscape is a prime example of this.

- Divest from a property but maintain the business operational on the existing site.

The sale of the property gives the seller access to the equity in the property, allowing them to reinvest the funds in the business or utilize as needed. The lease agreement is executed at the same time as the sale, and the seller becomes the tenant while the buyer becomes the landlord.

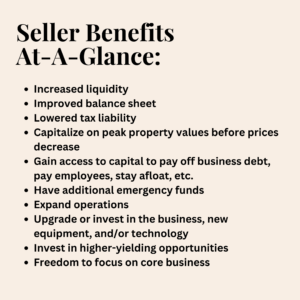

The transaction benefits sellers because they can:

- Capitalize on peak property values before prices decrease. This is particularly important for office property owners.

- Write off the entire lease payment instead of just the interest on the mortgage loan.

- Remain in the same location without incurring moving costs and disturbing business operations.

- Improve their debt-to-income ratio, balance sheet, and income statement

- At the time of the sale, the existing mortgage loan will be removed from the balance sheet.

- Interest and depreciation are also removed from the property owner’s financials.

- Benefit from a lower cost of funds than debt financing through off-balance sheet financing.

- Since sale-leaseback investors get the tax benefits of owning and depreciating the property, the seller can often be successful in obtaining a lower cost of capital than the cost of debt.

For more information on how your clients can leverage and benefit from a sale-leaseback on their office property, contact me for a consultation. I’ve been helping office property owners sell or lease their space in the Tampa area for over 15 years.